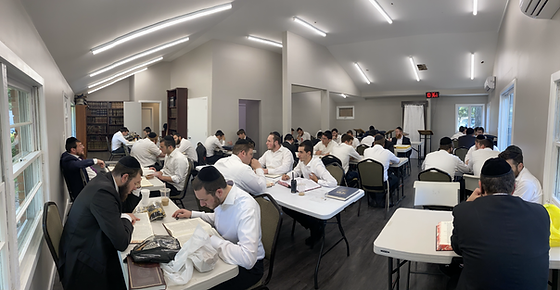

Yeshiva Nishmas Chaim, which is located on New Central Avenue in Lakewood, is a unique yeshiva which aims to ensure that bochurim who will be spending part of their day in the workforce have a solid schedule of learning, with a strong sevivah and the benefits of a cohesive chaburah of bnei Torah.

With no plausible explanation, back in May 2021, Township officials filed an appeal with the Ocean County Board of Taxation seeking to remove the yeshiva's property tax exemption.

The hearing notice sent to the yeshiva did not indicate that the tax exemption status was to be reviewed, so the Yeshiva did not send representation at the hearing.

Due to their lack of appearance, the County Board granted this appeal and assessed the property at $812,200. Based on this assessed value, the Township Tax Collector imposed a $18,501.92 annual tax bill.

The Yeshiva paid this tax bill and also filed legal action in Tax Court of New Jersey contesting the action of the County Board of Taxation, asserting that the tax exempt status was mistakenly removed by the Tax Board.

The lawsuit, filed by Neptune Attorney Jonathan Fleisher Esq. sought judgment "reducing the assessment.to the correct assessable value of the said property and such other relief as may be appropriate."

After all this time, the Township, represented by Attorney Lani Lombardi Esq. of Cleary Giacobbe Alfieri Jacobs LLC, has finally agreed to settle this matter and grant the yeshiva an exemption from property taxes retroactively for 2021.

The parties recently filed a Stipulation of Settlement for Entry of Judgment which has been signed by Judge Kathi F. Fiamingo, J.T.C.

On Thursday afternoon, the Township Committee is expected to formally authorize the $18,501.92 refund, FAA News has confirmed.

To join a FAA News WhatsApp Group, click here.

To join the FAA News WhatsApp Status, click here.

4 comments:

Nothing happens by mistake. What really happened?

I guess they’re not affiliated with Kotler Kotler & Kotler LLP

Glad the swamp Lost this attempt at manipulative behavior. Township didn't fight it accidentally for 2 years, if it truly was a mistake by the Township. Swamp ain't bright for picking this particular battle, which is clear cut it would lose. Swamp creatures have started to lose their grip on this town. Thank you lord 🙏

They give exempt status to some that are not entitled, that's why they have to make some others the pascal lamb and they have to spend legal fees to get what the legislature provided for.

Someone is not home, must be busy giving LSTA among others millions of undeserving tax payer dollars.

Let's correct it at the ballot box, as Jackson Township says.

Post a Comment